Vision

At Mitr Phol, we aim to produce and offer high quality products for our consumers with the best of our efforts in every process we do

At Mitr Phol, we have a firm conviction that human resources are the most valuable resources of the organization. We take pride in encouraging every team member to gain knowledge and skills in what they do. It is our commitment to enhance the performance of Mitr Phol Group by combining the individual talents of our human resources

At Mitr Phol, we conduct our business with utmost integrity and are fair in dealing with our stakeholders, especially our employees, farmers, partners, suppliers, customer and consumers

At Mitr Phol, we are committed to operate our business under the respected principle of “Grow Together” that emphasizes on social and environmental development no less than business development

Mitr Phol Group is committed to conducting business with responsibility under the concept

“From Waste to Value Creation”. Our goal is to optimize resource management to achieve the greatest benefits, minimize waste, and add value to the waste generated during the production process. Mitr Phol Group leverages digital innovation and technology to deliver high-quality products that meet international standards while reducing greenhouse gas emissions, a major driver of climate change.

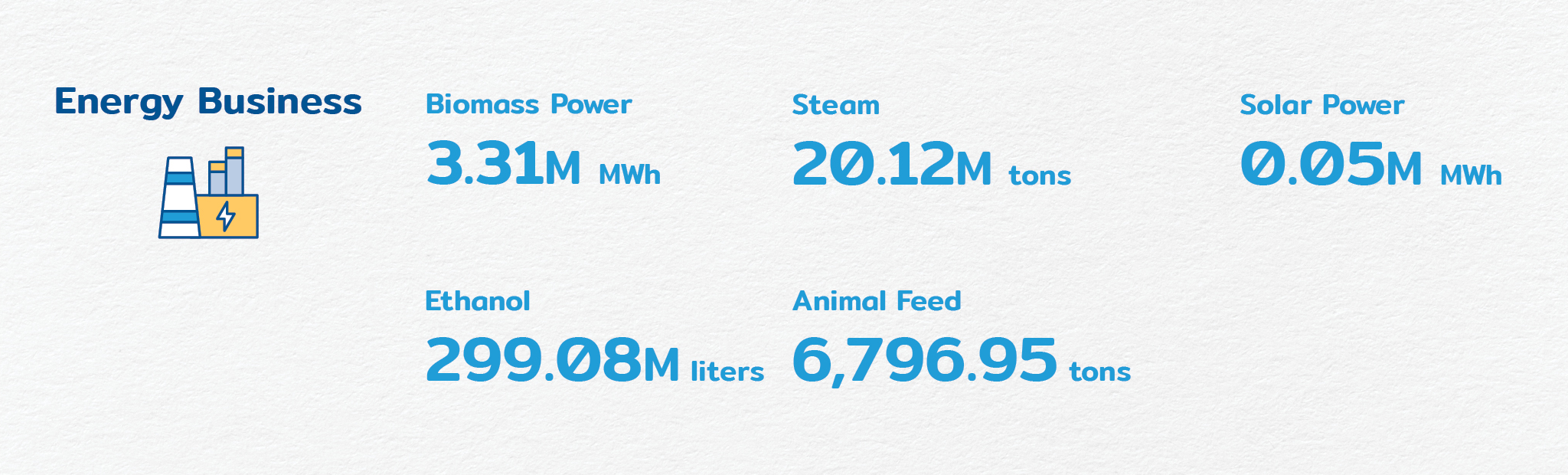

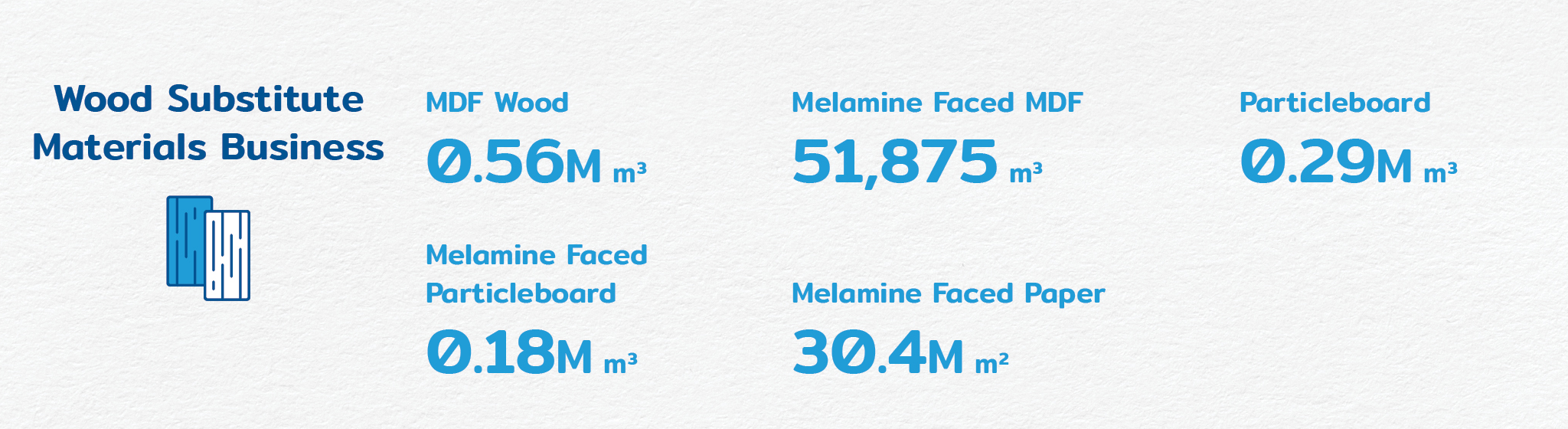

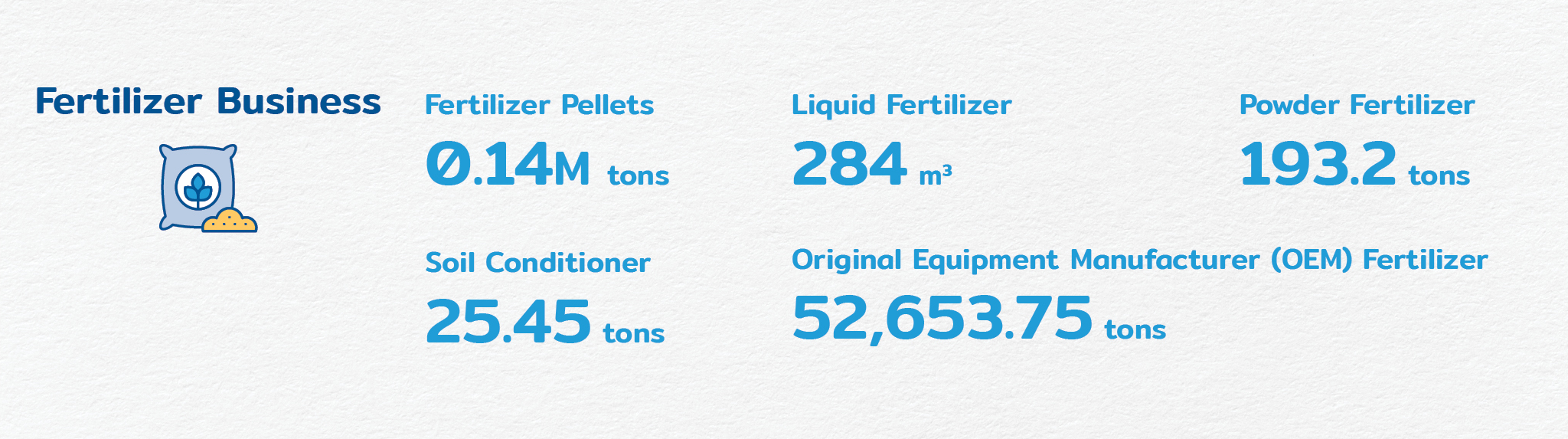

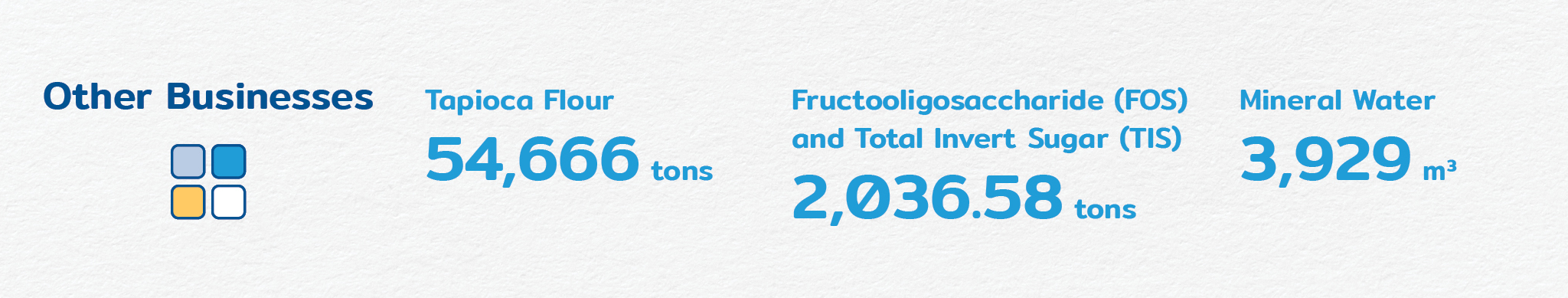

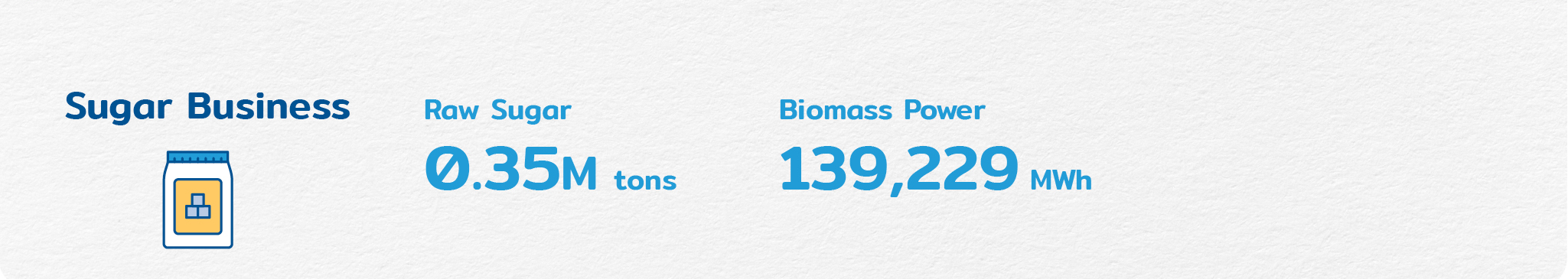

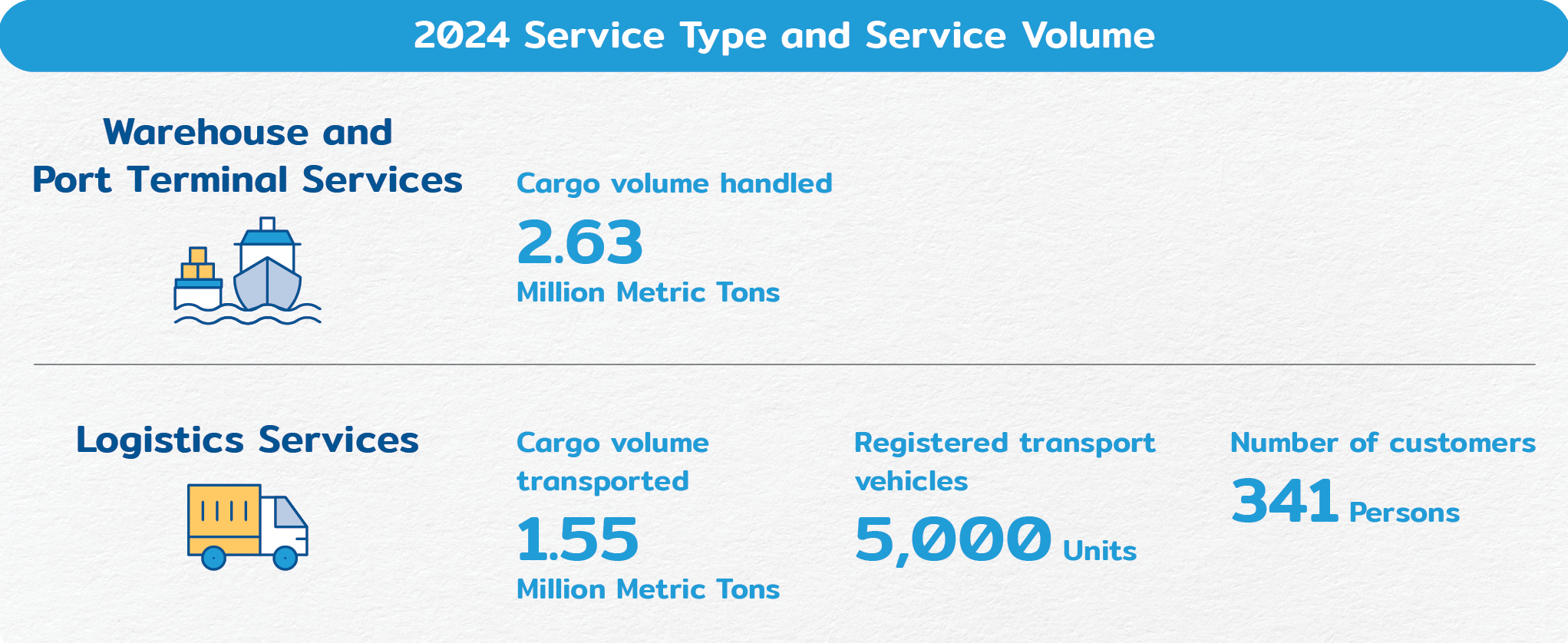

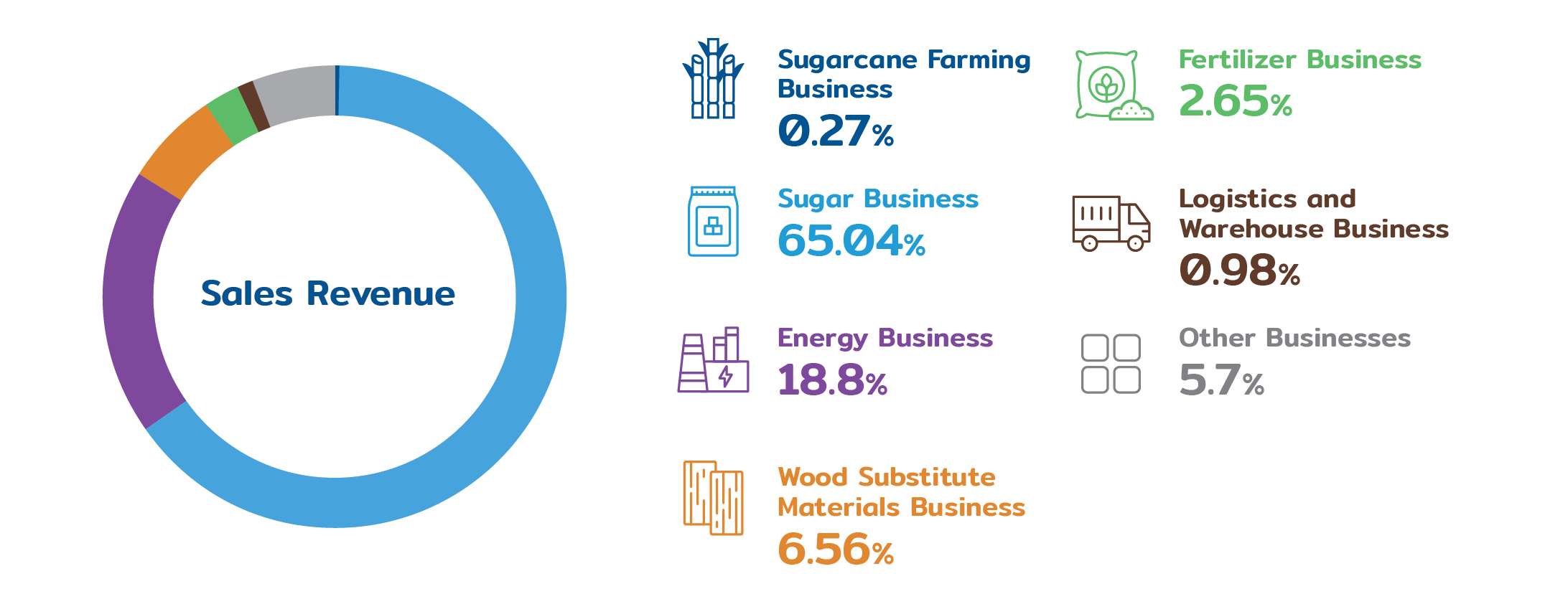

In 2024, Mitr Phol Group became the world’s 4th largest sugar producer and the number 1 in Thailand. This achievement underscores our success in becoming a leader in the sugarcane and sugar industry, earning the trust of customers and consumers both in Thailand and overseas. Currently, Mitr Phol Group operates in 7 business types: Sugarcane Farming, Sugar, Energy, Wood Substitute Materials, Fertilizer, Logistics and Warehousing, and Other Businesses.

Remark

*Refined sugar includes white sugar, refined sugar, and super-refined sugar.

*VHP Sugar stands for Very High Polarized Raw Sugar —raw sugar with a minimum sweetness of 99.4%.

**DCR stands for Direct Consumption Raw Sugar — edible raw sugar that does not require further refining.

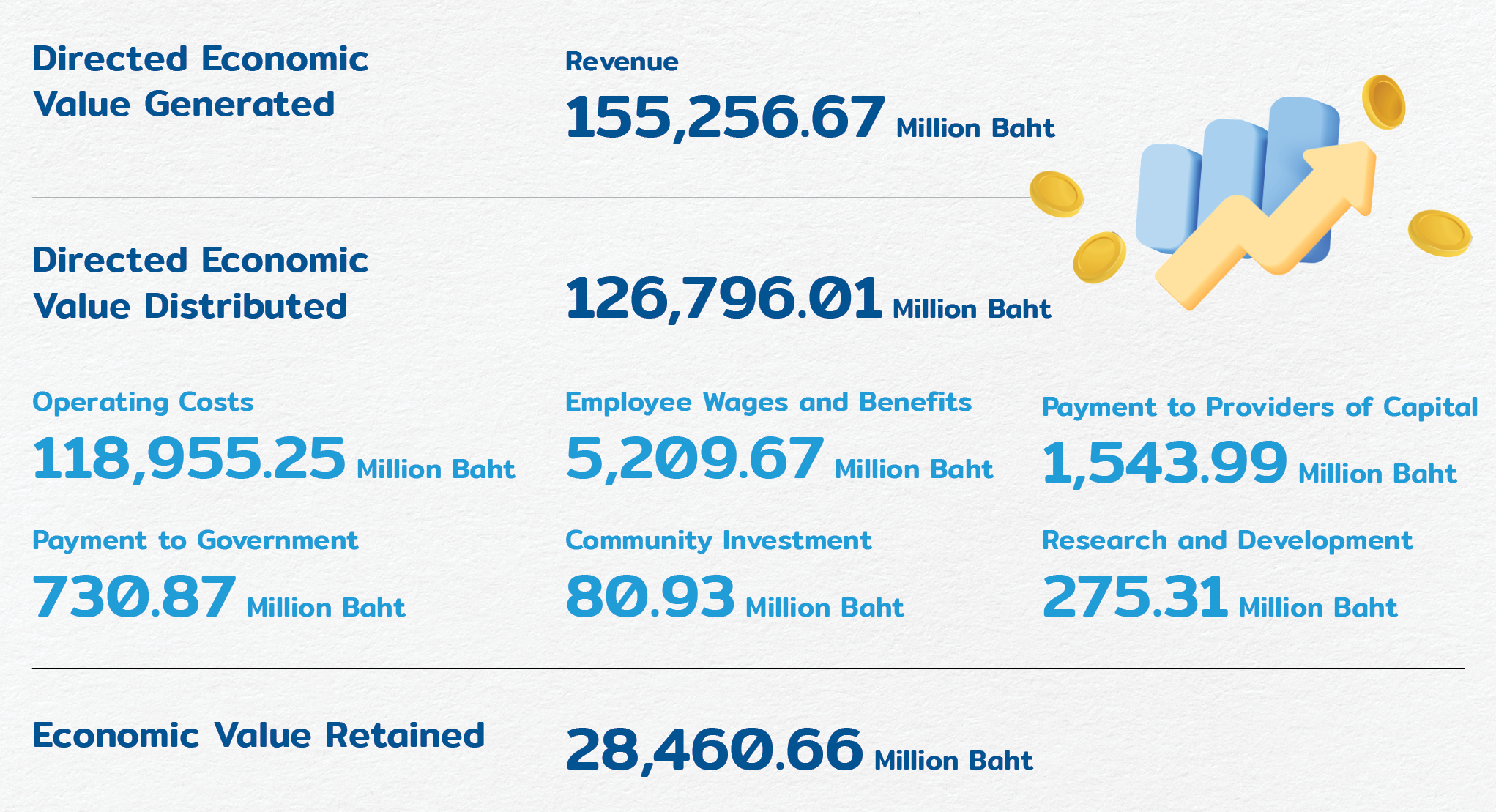

In 2024, Mitr Phol economic performance highlights are shown below:

Mitr Phol Group firmly believes that conducting business in accordance with the principles of good corporate governance is essential to fostering sustainable business growth and driving national development. As such, the Company places a strong emphasis on effective tax management, recognizing that a sound tax policy is not only a part of social responsibility but also a key contributor to economic stability and sustainable national progress. Regardless of where we operate, we are fully committed to complying with all applicable tax laws and regulations and to playing an active role in supporting the overall development of the countries in which we do business. Additionally, the Company has established channels for submitting suggestions, whistleblowing, or filing complaints regarding tax issues.

Mitr Phol Group has a dedicated unit for tax planning and accounting standards to ensure full compliance with relevant government agencies and tax authorities. We engage professional tax advisors and provide regular training to employees responsible for tax matters to ensure they possess the necessary skills, expertise, and knowledge to manage tax operations with the highest level of efficiency.

Additionally, Mitr Phol has established robust processes for tax risk management and internal audits to mitigate potential tax-related risks to the business. Regular monitoring and evaluation through KPIs ensure maximum operational efficiency. The Senior Executive Vice President of Finance and Acting Chief Operations Officer for the Administrative Group is responsible for developing and overseeing the Group’s tax policies. The Company also engages external tax experts to provide advisory support, ensuring full compliance with all relevant tax laws and regulations. Tax disclosures are presented in the consolidated financial statements of Mitr Phol Sugar Corp., Ltd., and its subsidiaries. The Company complies with all applicable tax obligations, including corporate income tax, value-added tax (VAT), excise tax, and other business-related taxes. Corporate income tax payments are disclosed on a country-by-country basis, along with the corresponding effective tax rates, and are reported annually in the Company’s tax report.

As of December 31st, 2024, Mitr Phol Sugar Corp., Ltd. is registered as a Company limited, with business registration number 0105518011759. The headquarters is located at 2 Ploenchit Center Building, 3rd Floor, Sukhumvit Road, Klong Toei, Bangkok 10110, Tel: +66 2794 1000, Website: http://www.mitrphol.com

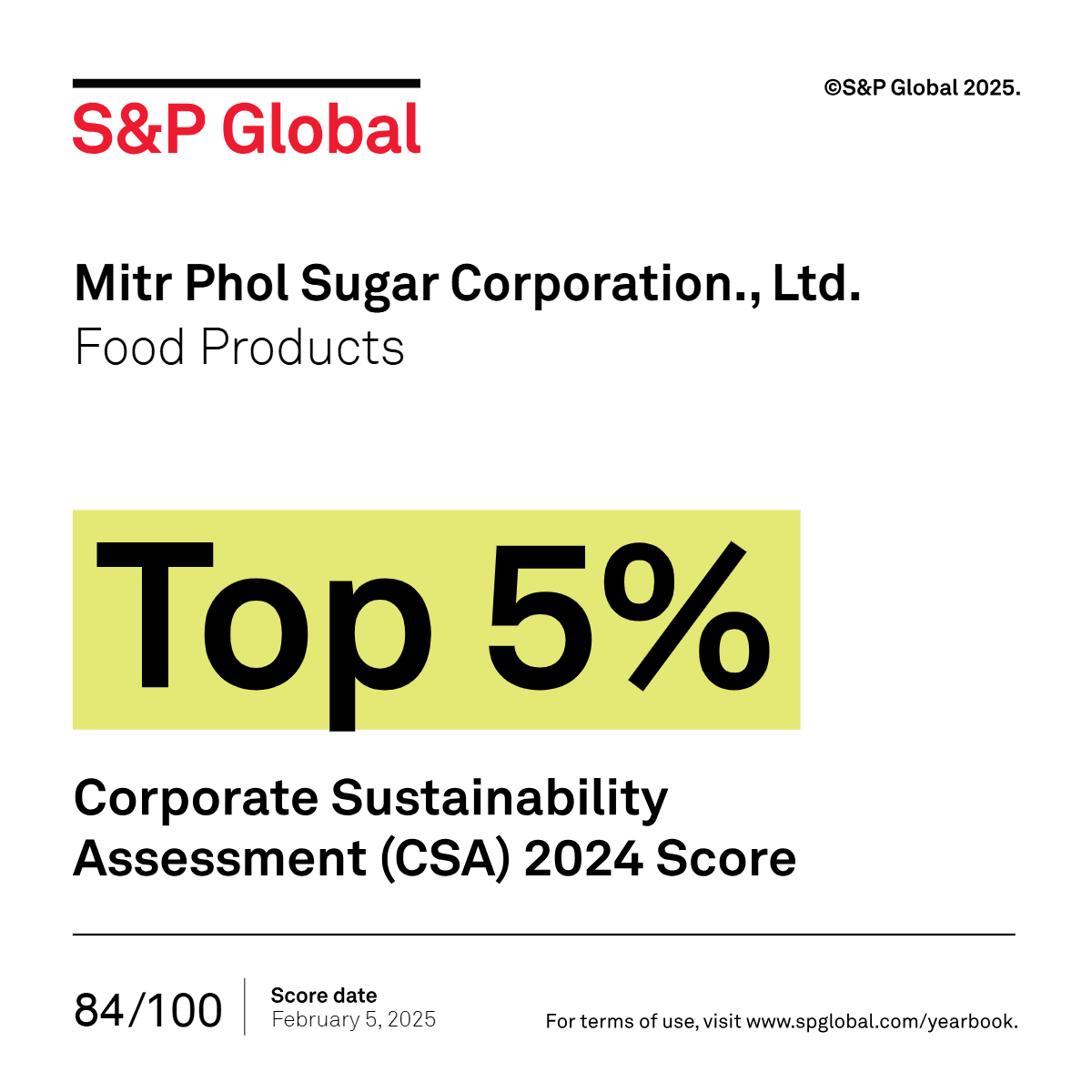

Mitr Phol Group, The world's leading sustainable company in the food products industry has been recognized in the S&P Global Corporate Sustainability Assessment (CSA) ESG Score 2024. This assessment included over 7,690 companies across 60 industries worldwide. Furthermore, Mitr Phol Group has been selected as a member of ‘The Sustainability Yearbook Member 2025’ for the sixth consecutive year, underscoring its unwavering commitment to sustainable development alongside its business operations.

Mitr Phol Group has been assessed by the CDP (Carbon Disclosure Project)

for the year 2024, achieving a Climate Change Management score of B and

a Water Security Management score of B-, both of which are higher than the global and Asia averages of C.

CDP is a global non-profit organization dedicated to climate change management, renowned for its international standards in carbon disclosure and climate change reporting. It is also one of the most trusted organizations worldwide among investors and various stakeholders.